Award Winning Company

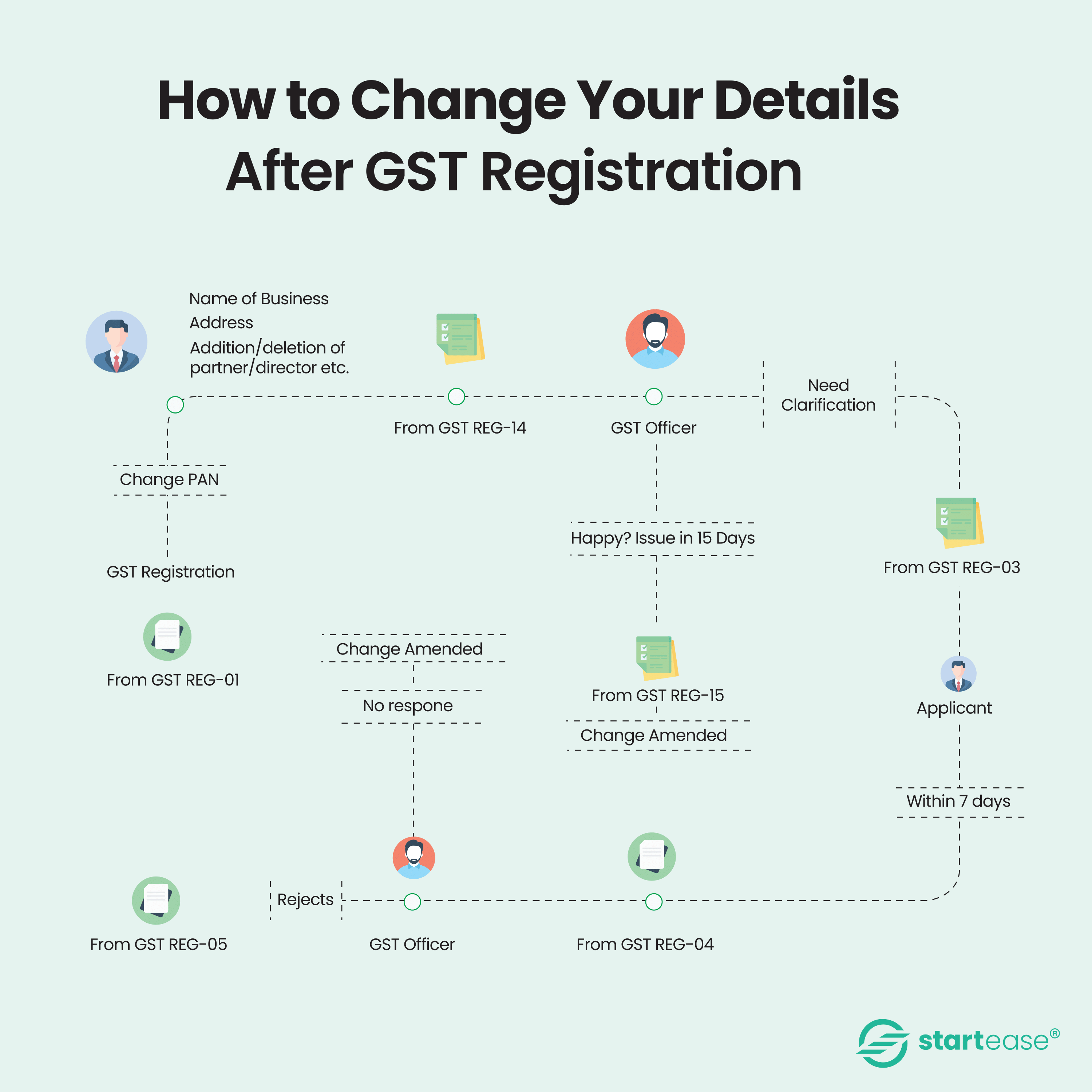

Get a modification for your current GST registration with StartEase

Choose StartEase services to receive professional advice on modifying the current registration and form-filling procedures for simply "price".

Get In Touch

become a client

Ready to Get Started?

Dedicated Support

Dedicated manager to process your GST.

100% Digital

Completely online no need to visit our offices.

Get GST Details

Secure GST Identification Number.

Stay Compliant With Govt. Laws

Filing of Application for GST Registration.